Report: UK Arrears Continue to Climb in Q4

31 January 2024

This report is the latest in a series that tracks mortgage data across Pepper Advantage’s UK portfolio of over 100,000 residential mortgages.

It is important to note at the outset that our portfolio has a higher composition of borrowers who qualify for needs-based support and are therefore more likely to be acutely impacted by the cost-of-living crisis than the broader UK mortgage market. Our data reflects this concentration.

The Q4 analysis of Pepper Advantage’s UK portfolio reveals that sustained pressure on borrowers is consistently flowing through into higher arrears. This trend was evident throughout 2023, and the arrears rate1 in the final quarter once again reached a post-financial crisis high. Moreover, the UK continues to face a challenging economic environment. Inflation unexpectedly rose in December, underlining compounding pressures on households that are navigating both high living costs and moderately declining, yet still elevated, interest rates. This sobering macroeconomic outlook is expected to impact Pepper Advantage’s portfolio throughout 2024.

Elsewhere in our report, direct debit rejections (DDRs), an early indicator of borrower stress, also grew in Q4, while new originations remained steady, extending the mild recovery seen in Q3.

Arrears Hit Yet Another Peak

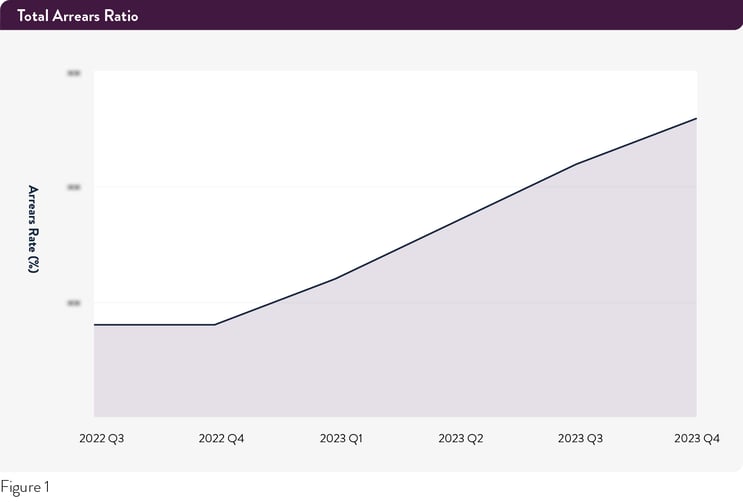

The percentage of mortgages in arrears across our UK portfolio grew 5.7% in Q4 2023 compared to the previous quarter and 29.5% compared to Q4 2022. The graph below shows the consistent climb in the arrears rate throughout 2023. Q4 represents yet another post-financial crisis high.

This steady increase in the arrears rate is in line with expectations given the growth in direct debit rejections (DDRs) noted in previous reports. As we noted last quarter, the continuing increase in the DDR rate would indicate that the growth in arrears has not yet peaked.

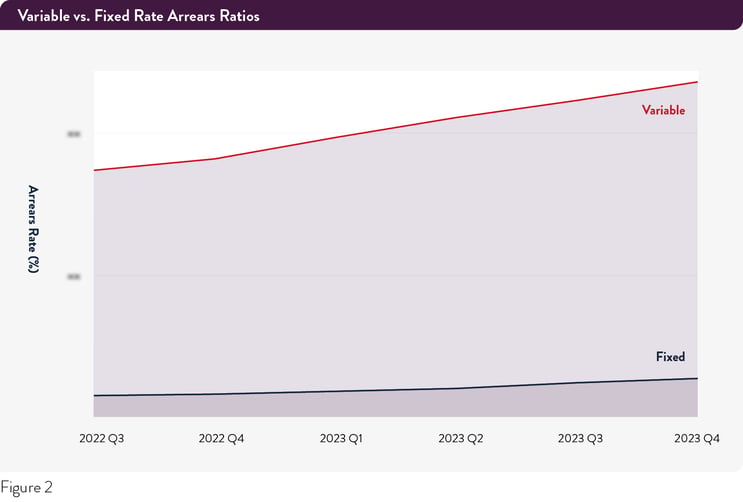

A breakdown of Q4 arrears by product type shows that the percentage of fixed rate mortgages in arrears grew 13.0% quarter-on-quarter and 65.7% year-on-year. These growth rates are in line with what we saw in Q3. It is important to note that they represent growth from a very low base and that the overall percentage of fixed rate mortgages in arrears remains small.

The percentage of variable rate mortgages in arrears grew 5.7% quarter-on-quarter and 29.6% year-on-year off a much higher base.

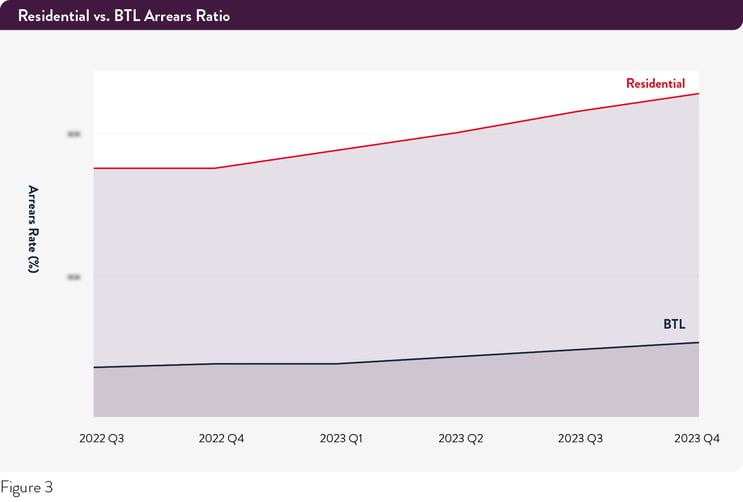

The percentage of Buy-to-Let mortgages in arrears in Q4 2023 continued to creep upwards, again following the trend seen in Q3. BTL mortgages, which make up 9% of the overall UK housing stock, are a historically stable part of the residential mortgage market. The small yet noticeable growth in BTL arrears indicates that pressure is growing across all customer segments, but it is important to note that BTL mortgages continue to demonstrate overall resilience.

The percentage of residential mortgages in arrears grew 5.6% compared to Q3 and 29.0% year-on-year.

Although we do not expect any significant increase in the Bank Rate in 2024, the confluence of economic factors has put significant strain on household budgets. Additionally, around 45% of fixed-rate mortgage deals entered into before December 2021—prior to the Bank Rate increases—have yet to expire, and are set to renew at much higher rates, further pressuring mortgage payments.

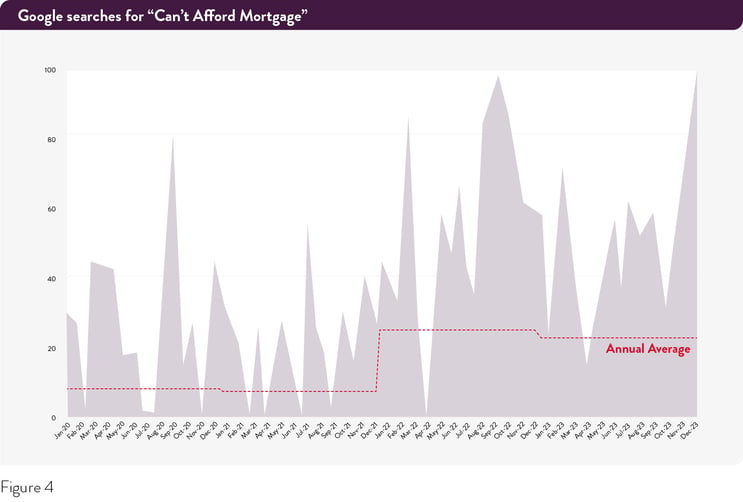

Our data is backed by recent analysis of Google Trends in the UK, which showed a spike in searches for the term “Can’t afford mortgage”. Searches for this term increased 200% on average in 2023 compared to 2021, with a notable uptick in December 2023, indicating growing worry from UK mortgage holders in the face of rising interest rates.

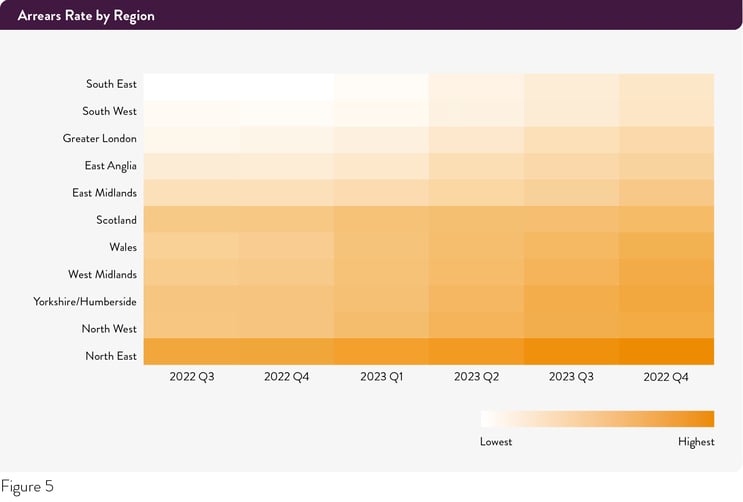

A geographic breakdown shows that all regions are following the nationwide trend of increasing year-on-year growth in the arrears rate (figure 5).

As in Q3, the regions with the highest absolute rate of arrears are the North East, Yorkshire and Humberside, the North West, and the West Midlands. The South East, South West and Greater London had the lowest arrears rates in the UK.

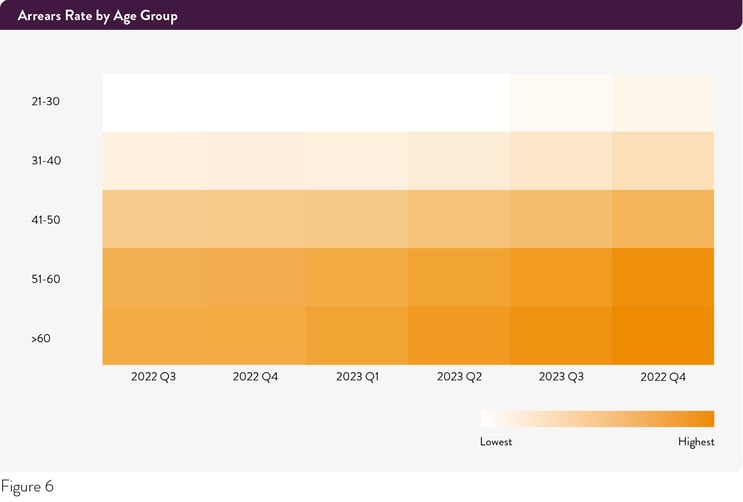

Looking at the arrears rate by age shows continued growth across the board, with each group increasing between 0.3 and 0.8 percentage points quarter-on-quarter, compared to growth of between 0.3 and 0.6 percentage points in Q3 2023. Those aged 51-60 and 60+ showed the highest level of arrears followed by those aged 41-50.

Direct Debit Rejection Growth Rate Accelerates

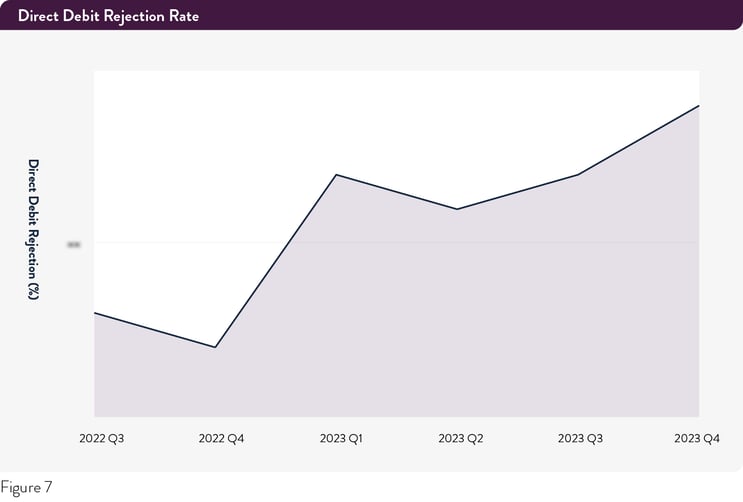

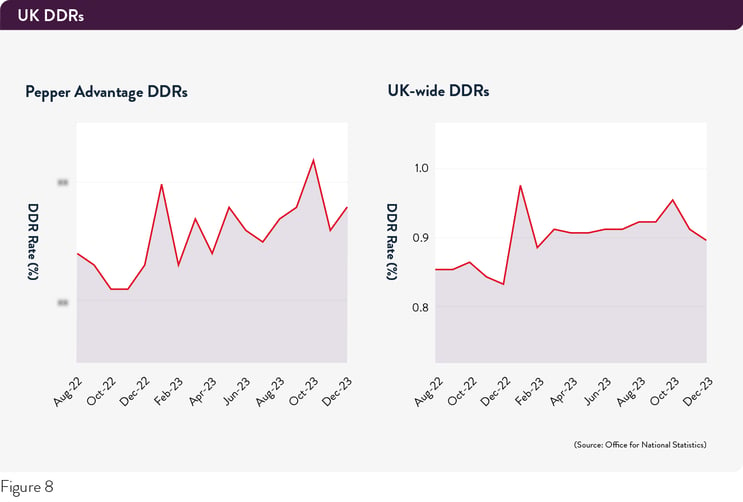

The percentage of residential mortgages that experienced a direct debit rejection2 in Q4 2023 grew 6.9% quarter-on-quarter and 30.8% year-on-year, marking a more dramatic increase compared to what we saw in Q3 (figure 7). DDRs tend to be cyclical in nature and the increase in the year-on-year growth rate in Q4 reflects the cumulative effect of ongoing cost of living pressures and reduced savings in the run up to the holidays.

The increase in direct debit rejections seen in our portfolio is mirrored by larger DDR trends across the UK. According to data from the ONS, the direct debit rejection rate in the country grew 15% in December 2023 compared to December 2022 and a notable 27% compared to the pre-pandemic DDR baseline.

These growth rates are primarily attributed to a substantial 39% rise in the "electricity and gas" spending category, reflecting a cost-of-living impact, and a 20% increase in the "mortgages" category, indicating growing pressure on mortgage payments. This trend matches our own data and offers further evidence that arrears have not yet peaked.

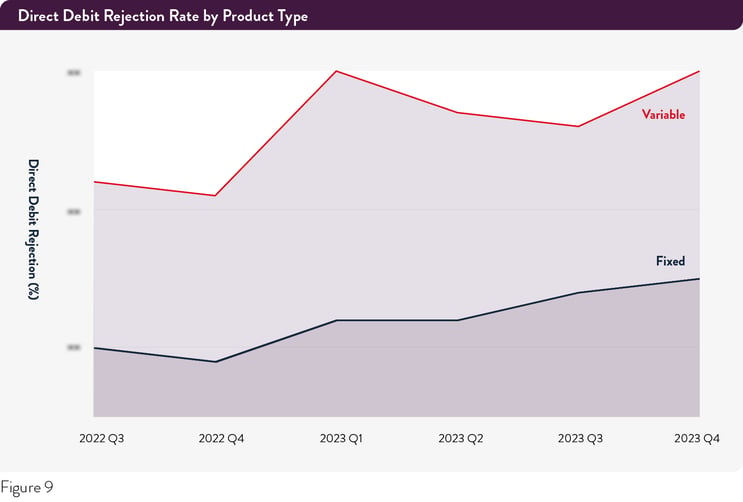

Looking at direct debit rejections across different mortgage types (figure 9) shows that the percentage of fixed rate and variable rate mortgages with a DDR in Q4 2023 grew 34.6% and 28.3% compared to Q4 2022. These figures compare to year-on-year growth of 25.0% and 14.4% in Q3, respectively. It is important to note that variable rate mortgages had a significantly higher overall rate of DDRs.

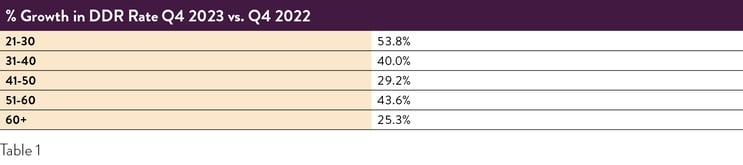

All age groups saw significant year-on-year growth in DDRs, ranging from 25.3% (those aged 60+) to 53.8% (21-30). This reverses the trend seen in Q3, which showed largely slowing growth in DDRs. The Q4 reversal can be attributed to the cumulative effect of a challenging 18 months for UK borrowers heading into the holiday season.

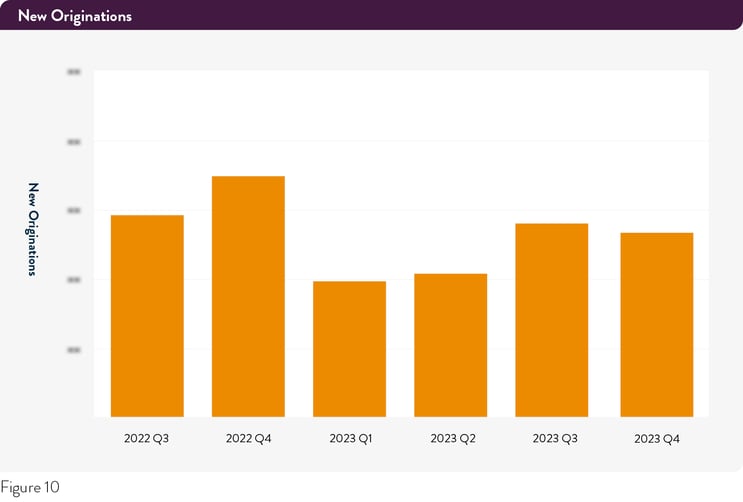

New originations steady following Q3 rebound

Pepper Advantage manages organic origination for 10 UK originators, 80% of which are capital markets funded. In Q3 2023, new originations grew 35.2% compared to Q2 2023, which was one of the lowest quarters for new originations since the global financial crisis. New originations in Q4 2023 were down 4.7% compared to Q3, but this includes fewer new originations in December, which is a month that sees lower activity given the holidays. The overall trend in Q4 would align with the rebound seen in Q3.

What next?

Our data indicates that the first half of 2024 will be a period of continued stress for borrowers. Pepper Advantage’s portfolio, which includes a greater percentage of borrowers who qualify for needs-based support, represents a group of mortgage holders that is more likely to be sharply impacted by the high cost of living than portfolios held by more traditional lenders. The ongoing pressure facing these borrowers is expected to continue to flow into arrears as the ongoing effect of higher interest rates reaches more customers.

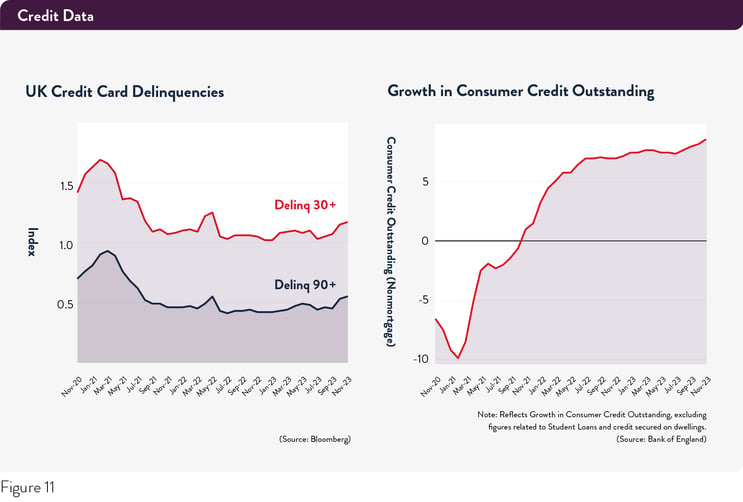

The charts below show a notable increase in credit delinquencies and a consistently expanding outstanding consumer credit base across the UK, furthering reinforcing our analysis of the squeeze facing borrowers.

The longer-term outlook remains choppy, as some positive economic indicators, such as moderating inflation and wage increases, have yet to show themselves in improved mortgage payment rates. Our expectation is that payment challenges will continue to grow in the short term – a case of things getting worse before they might get better.

Pepper Advantage is using this analysis to ensure we identify and support borrowers who are experiencing the strongest payment pressures, implementing strategies such as term extensions and temporary interest rate reductions when and where they are most needed. We continue to leverage data models to ensure resources are available to support customers through what is expected to be a challenging 2024.

For more information, please contact us here.

Why Pepper Advantage?

Pepper Advantage is a global credit intelligence company that offers a range of data-led and credit management services via a technology platform that spans Asia, Europe, and the United Kingdom. The company operates in multiple asset classes including residential and commercial mortgages, real estate, SME loans, asset financing and leasing, auto and consumer loans, credit cards, retail finance and BNPL, in addition to offering a number of outsourced operational support services to both financial and non-financial clients. It helps investors, financial institutions, fintechs, and banks manage their credit portfolios, reducing the cost and complexities of systems and supporting new non-bank lending, with a particular focus on clients whose customers are underserved by traditional mainstream lenders.

Pepper Advantage's Credit Intelligence platform transforms real-time global data and analytics into valuable information, so that you can make insight-driven decisions to benefit your business and your customers’ financial experiences.

To find out more about Pepper Advantage and our Credit Intelligence platform, click here.

Trusted by

Our clients range from some of the most established and recognised incumbents in the world to new challengers and fintechs. We service private equity and institutional investors, hedge funds, major banks, property developers, fintechs, non-bank lenders and retailers. We manage 125 institutional clients – a number that continues to grow, having increased by 40% since December 2022.

-

Mortgages in arrears are those that are 30+ days delinquent in payment.

-

A direct debit rejection is a form of missed mortgage payment that typically occurs due to insufficient funds when a direct debit is called and is an early indicator of borrower stress. A borrower who experiences a DDR can often manage for a period before falling into arrears, which is why there is an assumed lag between rising DDRs and rising arrears.

Disclaimer

The material contained in this Article (the “Material”) has been prepared by Pepper Advantage Technologies Limited (“Pepper”).

No representation or warranty, express or implied, is or will be made with respect to the accuracy, completeness, usefulness or merchantability of the Material or its fitness for a particular purpose or regarding the accuracy of the assumptions or the output or the appropriateness of the parameters used in the calculation of any projections or estimates set out herein or the correlation of the data to the actual or expected performance and characteristics of any transaction and no liability or responsibility is or will be accepted by Pepper or any of its affiliates or associated companies or any of their respective directors, officers, employees or agents in relation thereto. Any use of the Material by the Recipient for any purpose whatsoever will be entirely at the Recipient’s own risk.

This Material may utilise information which has not been independently verified and may include that from public sources and third parties (including market and industry data). Further, this Material may contain forward-looking statements, estimates, forecasts and projections that may be affected by inaccurate assumptions, expectations and estimates and by known or unknown risks and uncertainties are predictive in character and inherently speculative and may or may not be achieved or prove to be correct. The Recipient should not place reliance on such statements.

By accepting the Material, the Recipient acknowledges that (a) Pepper is not in the business of providing advice including legal, tax or accounting advice, (b) there may be financial, legal, tax or accounting risks associated with any transaction, (c) it will seek advice from advisors with appropriate expertise to assess relevant risks and independently determine, without reliance upon Pepper, the economic risks and merits of any transaction and that it is able to assume any such risks and that (d) nothing herein shall form the basis of or be relied on in connection with any contract or commitment whatsoever and neither Pepper nor any of its agents accept liability for any loss howsoever arising, whether direct or consequential, from, related to or in connection with any use of the Material or otherwise arising in connection herewith.

Your receipt and use of the Material constitutes notice and acceptance of the foregoing.

Most read

Pepper Advantage to Acquire Computershare’s UK Mortgage Servicing Business

J.C. Flowers Acquires Pepper Advantage from Pepper Global

Pepper Advantage will manage Servicios Prescriptor y Medios de Pagos loans

Prism: Powering the Future with Innovation, Data, and Customer-Centric Technology

Pepper Advantage Announces Closure of Acquisition by J.C. Flowers to Fuel Company’s Next Growth Phase

Cookie settings