UK Arrears Hit New High

31 October 2023

This report is the latest in a series that tracks mortgage data across Pepper Advantage’s UK portfolio of over 100,000 residential mortgages.

It is important to note at the outset that our portfolio has a higher composition of borrowers who qualify for needs-based support and are therefore more likely to be acutely impacted by the cost-of-living crisis than the broader UK mortgage market. Our data reflects this concentration.

A recent analysis of Pepper Advantage’s UK portfolio shows an environment of continued pressure on borrowers. The arrears rate1 in Q3 2023 hit a new post-financial crisis high, indicating that stress on mortgage holders remains elevated and is flowing through to a higher level of defaults. Macroeconomic factors, such as the reduction in household savings and declining employment levels, which currently stand at 75.5% (1.1 percentage points lower than before the pandemic), continue to impact wider portfolio performance.

While the overall picture in Q3 is one of stress for borrowers and uncertainty for the market, the slowing growth rate of Direct Debit Rejections (DDRs)2, an early indicator of borrower stress, and a slight recovery in new originations from springtime lows, provide two positive developments against the gloomy backdrop.

Direct Debit Rejection Growth Rate Slows

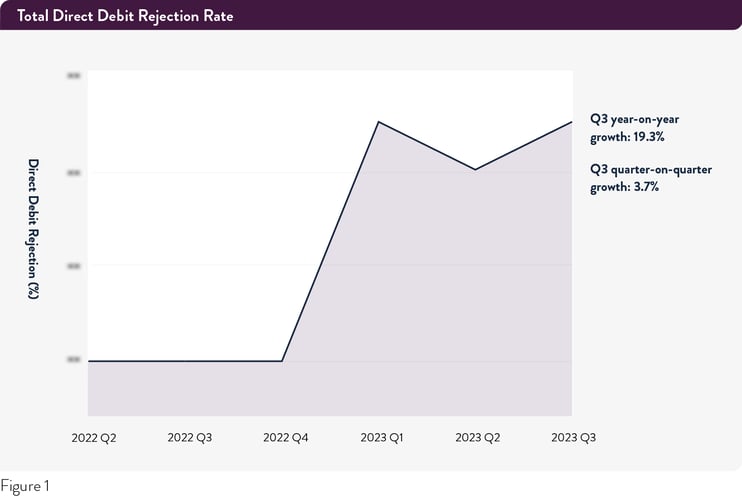

Q3 2023 saw decelerating year-on-year growth in the percentage of residential mortgages across Pepper Advantage’s UK portfolio that experienced a direct debit rejection (DDR). The DDR rate increased 19.3% percent compared to Q3 2022, which compares to year-on-year growth of 33.3% in April 2023, our last reported data.

A direct debit rejection is a form of missed mortgage payment that typically occurs due to insufficient funds when a direct debit is called and is an early indicator of borrower stress. A borrower who experiences a DDR can often manage for a period before falling into arrears, which is why there is an assumed lag between rising DDRs and rising arrears. While an increase in DDRs (figure 1) indicates that UK arrears are also likely to continue to rise, the year-on-year growth rate is less severe than what we saw in April 2023.

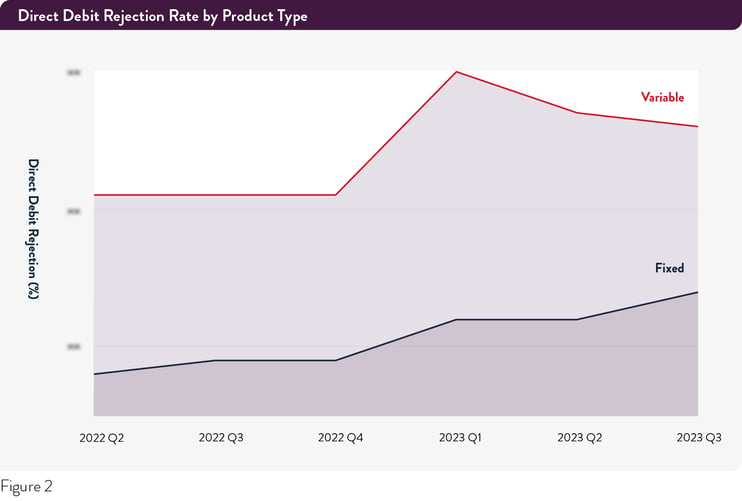

Looking at Direct Debit Rejections over the 12 months through September 2023 across different mortgage types (figure 2) reveals that the percentage of fixed rate and variable rate mortgages with a DDR in Q3 2023 grew 25.0% and 14.4%, respectively, compared to Q3 2022, although it is important to note that variable rate mortgages had a significantly higher overall rate of DDRs. The DDR stress across variable rate mortgages is a direct result of the increasing rate environment, which is passed onto variable rate borrowers.

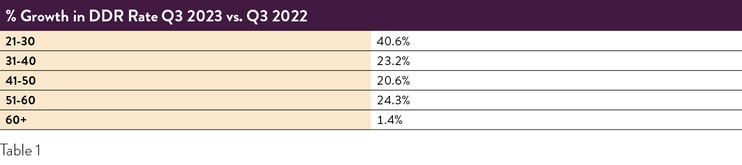

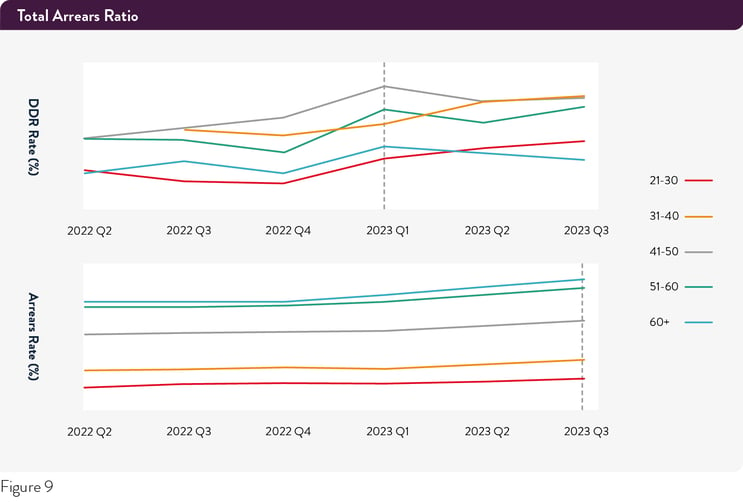

An age breakdown shows that those aged 21-30 saw the highest year-on-year increase in DDR rates in Q3 2023 – 40.6% growth over Q3 2022. While this figure represents the highest rate of increase compared to all other age groups, it still marks a significant drop compared to 70.0% year-on-year growth in April 2023.

All age groups recorded a drop in their DDR growth rates except those aged 31-40, who saw year-on-year growth of 23.2% in Q3 compared to 18.8% year-on-year growth last April.

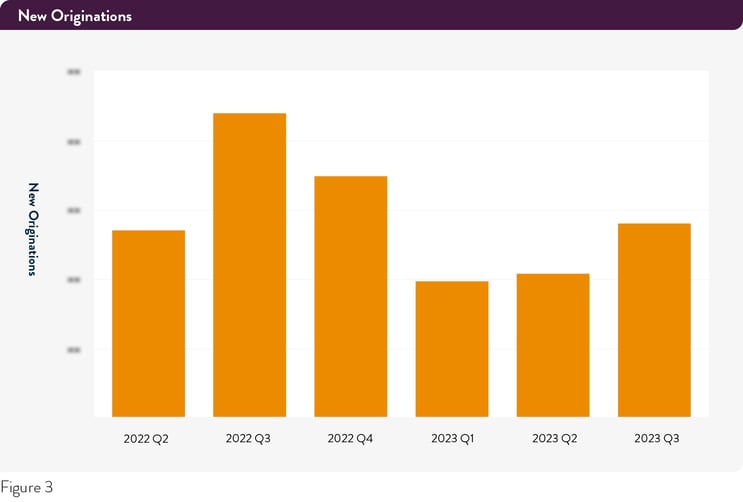

New originations see modest rebound from Q2 lows

Another new data set we are adding this quarter is new originations. Pepper Advantage manages organic origination for 10 UK originators, 80% of which are capital markets funded. New originations in Q3 2023 increased 35.2% compared to Q2 2023, one of the lowest quarters for new originations since the global financial crisis. This contrasts to a year-on-year fall of 36.3% in new originations since Q3 2022.

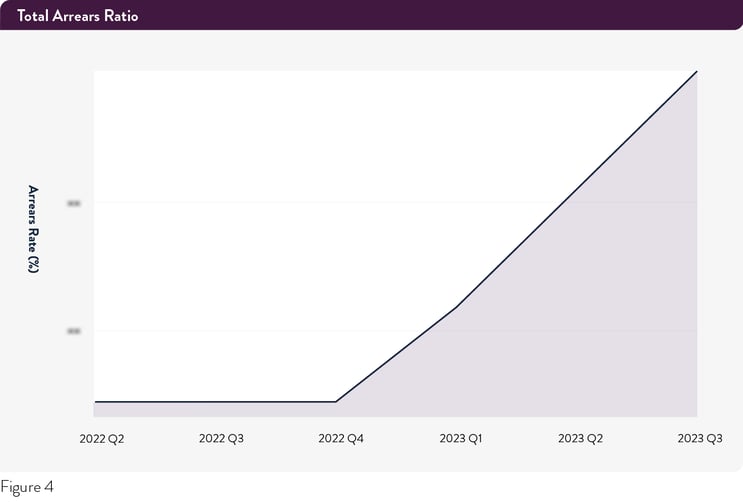

Arrears rate reaches new high

The increase in new originations and slowing year-on-year growth in the rate of DDRs across our UK portfolio are positive signs occurring against a backdrop of increasing growth in the arrears rate, which has reached a new, post-financial crisis high.

In Q3 2023, the percentage of mortgages in arrears across our portfolio grew 7.0% quarter-on-quarter and 23.3% year-on-year. Again, it is important to reiterate that our portfolio has a higher concentration of borrowers who qualify for needs-based support than the broader market. The year-on-year growth in arrears in April 2023, the last reported data, was 11.3%.

This growth in the arrears rate is not unexpected given the increase in DDRs seen last autumn. DDRs are a reliable leading indicator of arrears, and the increase in the arrears rate is in line with what we would expect given the earlier trajectory of DDR growth. The fact that the DDR rate is still increasing – albeit less acutely – indicates that the growth in arrears has not yet peaked.

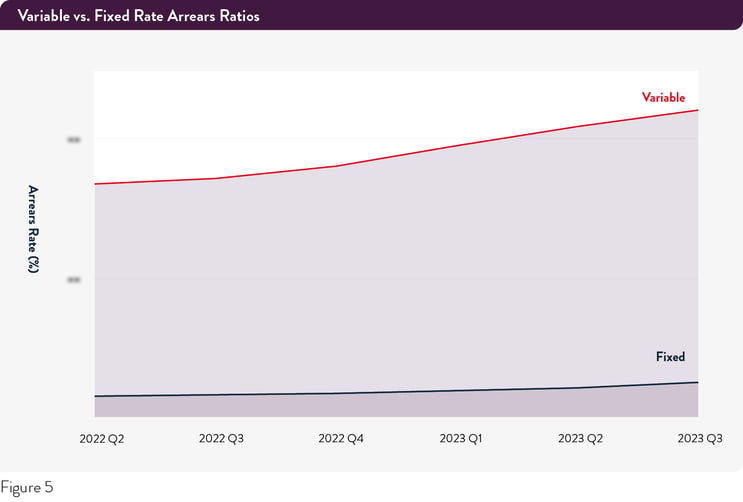

The arrears rate across our fixed rate mortgages grew 15.5% quarter-on-quarter and 53.7% year-on-year, but it is important to note these are off a very low base and the absolute percentage of fixed rate arrears remains small. The arrears rate for variable mortgages grew 5.6% quarter-on-quarter and 29.1% year-on-year, off a much higher base. Nearly one in four variable rate mortgages in our portfolio is currently in arrears.

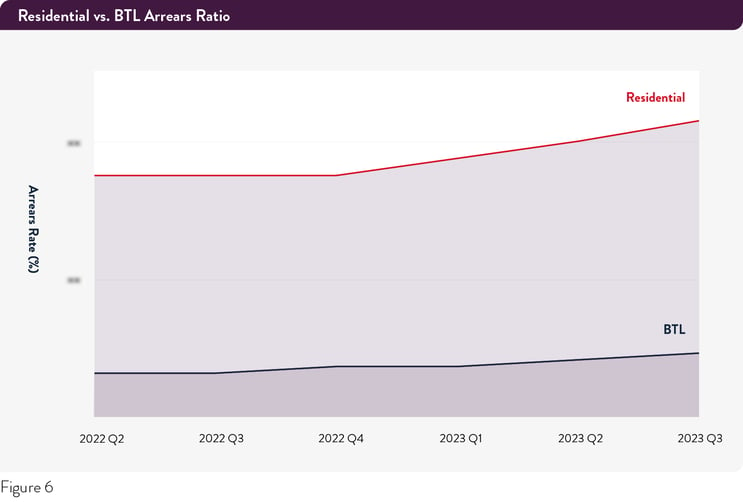

The rate of Buy-to-Let Arrears in Q3 2023 had marginal growth quarter-on-quarter off a very low base, while the rate of residential mortgages grew 7.0% off a higher base. It is striking to note that even BTL mortgages, a historically stable part of our portfolio, are showing small signs of growth in the arrears rate.

The charts below show the arrears rate climbing steadily throughout 2023 to date:

According to the Resolution Foundation, around half of mortgage cost increases have yet to hit borrowers, with the majority (90%) expected to arrive by Q4 2024, so we would expect this trajectory to remain on course next quarter. Further, according to data from UK Finance, households have continued to deplete their savings, with seasonally adjusted personal deposits eroding by £31.0bn in Q2 2023, in contrast to a saving accumulation of £12.0bn during the same period in 2022. Dwindling UK savings is also evidenced in our own portfolio, which shows that the ratio of loans with an overpayment in Q3 2023 dropped 13.0% year-on-year.

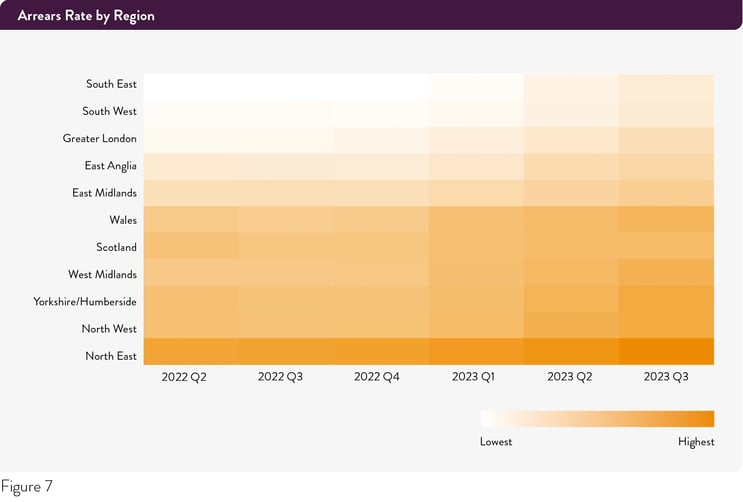

Moving back to arrears, a geographic breakdown shows that all regions are following the nationwide trend of increasing year-on-year growth in the arrears rate (figure 7).

The regions with the highest absolute rate of arrears are the North East, Yorkshire and Humberside, and the North West, which had arrears rates that ranged between 9% and 11% in Q3 2023. The South East, South West and Greater London had the lowest arrears rates in the UK, each around 5-6%.

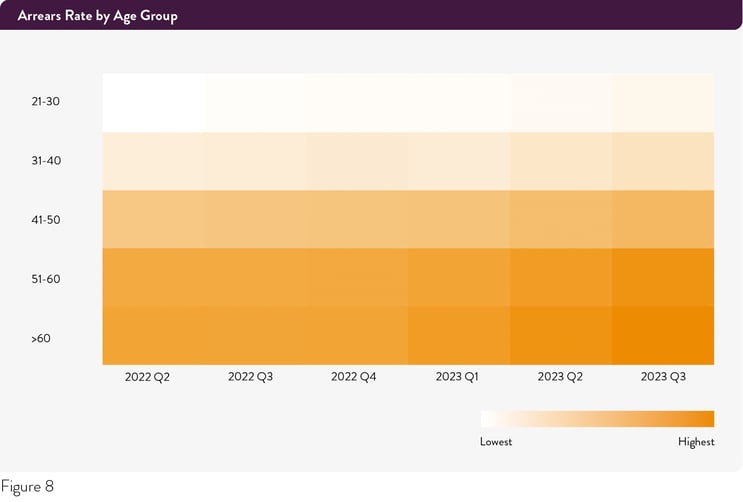

Looking at the arrears rate by age groups shows growth across the board, with each group increasing between 0.3 and 0.6 percentage points quarter-on-quarter. Those aged 51-60 and 60+ showed the highest level of arrears.

What next?

Pepper Advantage is using this data to see where and how UK borrowers are being affected – and how dramatically – by ongoing economic pressure. We are working with customers who are struggling to find solutions that can support them through this difficult period. The most used strategies so far this year are:

- Term extensions, which lengthens the loan term to provide borrowers more time to repay a mortgage;

- Interest rate reductions, which reduces the interest rate for an account for an agreed period to help borrowers who may be experiencing longer-term financial stress;

- Change to interest only, which is when a mortgage moves from a capital repayment plan to one that is interest-only for a certain period. This helps to reduce monthly payment amounts for borrowers.

The overall picture in Q3 is one of ongoing stress for borrowers. While we note a few positive developments in the economy, including less acute inflation and the Bank of England's decision to maintain a stable Bank rate, an air of uncertainty hangs over the market. Borrowers continue to be squeezed and are doing all they can to stay on top of their mortgage payments as pandemic savings dwindle. We are using our data to model how the upcoming holiday season could affect customers and are doing all we can to support them through what we anticipate will likely be a challenging Q4.

- Mortgages in arrears are those that are 30+ days delinquent in payment.

- DDRs are defined as a direct debit that has been processed by the creditor, but payment has not been received, accepted, or settled into the creditor’s account.

Why Pepper Advantage?

Pepper Advantage is a global credit intelligence company that offers a range of data-led and credit management services via a technology platform that spans Asia, Europe, and the United Kingdom. The company operates in multiple asset classes including residential and commercial mortgages, real estate, SME loans, asset financing and leasing, auto and consumer loans, credit cards, retail finance and BNPL, in addition to offering a number of outsourced operational support services to both financial and non-financial clients. It helps investors, financial institutions, fintechs, and banks manage their credit portfolios, reducing the cost and complexities of systems and supporting new non-bank lending, with a particular focus on clients whose customers are underserved by traditional mainstream lenders.

Pepper Advantage's Credit Intelligence platform transforms real-time global data and analytics into valuable information, so that you can make insight-driven decisions to benefit your business and your customers’ financial experiences.

To find out more about Pepper Advantage and our Credit Intelligence platform, click here.

Trusted by

Our clients range from some of the most established and recognised incumbents in the world to new challengers and fintechs. We service private equity and institutional investors, hedge funds, major banks, property developers, fintechs, non-bank lenders and retailers. We manage 125 institutional clients – a number that continues to grow, having increased by 40% since December 2022.

Disclaimer

The material contained in this Article (the “Material”) has been prepared by Pepper Advantage Technologies Limited (“Pepper”).

No representation or warranty, express or implied, is or will be made with respect to the accuracy, completeness, usefulness or merchantability of the Material or its fitness for a particular purpose or regarding the accuracy of the assumptions or the output or the appropriateness of the parameters used in the calculation of any projections or estimates set out herein or the correlation of the data to the actual or expected performance and characteristics of any transaction and no liability or responsibility is or will be accepted by Pepper or any of its affiliates or associated companies or any of their respective directors, officers, employees or agents in relation thereto. Any use of the Material by the Recipient for any purpose whatsoever will be entirely at the Recipient’s own risk.

This Material may utilise information which has not been independently verified and may include that from public sources and third parties (including market and industry data). Further, this Material may contain forward-looking statements, estimates, forecasts and projections that may be affected by inaccurate assumptions, expectations and estimates and by known or unknown risks and uncertainties are predictive in character and inherently speculative and may or may not be achieved or prove to be correct. The Recipient should not place reliance on such statements.

By accepting the Material, the Recipient acknowledges that (a) Pepper is not in the business of providing advice including legal, tax or accounting advice, (b) there may be financial, legal, tax or accounting risks associated with any transaction, (c) it will seek advice from advisors with appropriate expertise to assess relevant risks and independently determine, without reliance upon Pepper, the economic risks and merits of any transaction and that it is able to assume any such risks and that (d) nothing herein shall form the basis of or be relied on in connection with any contract or commitment whatsoever and neither Pepper nor any of its agents accept liability for any loss howsoever arising, whether direct or consequential, from, related to or in connection with any use of the Material or otherwise arising in connection herewith.

Your receipt and use of the Material constitutes notice and acceptance of the foregoing.

Most read

Pepper Advantage to Acquire Computershare’s UK Mortgage Servicing Business

J.C. Flowers Acquires Pepper Advantage from Pepper Global

Pepper Advantage will manage Servicios Prescriptor y Medios de Pagos loans

Prism: Powering the Future with Innovation, Data, and Customer-Centric Technology

Pepper Advantage Announces Closure of Acquisition by J.C. Flowers to Fuel Company’s Next Growth Phase

Cookie settings