Early indicator of borrower stress increases in line with interest rates

20 April 2023

- Direct debit rejections (DDRs) are the first indication of borrower stress that arise in our portfolio, and we can use them to predict levels of strain in the overall market.

- During the last six months of 2022, DDRs increased 7.85% across all our Spanish mortgage portfolios, a trend that correlates directly with increases in Euribor.

- By leveraging our rolling data, our analysis suggests there was an average monthly DDR increase of 0.6% for every ECB interest rate rise of 50bps in the second half of 2022. However, if rates continue to move higher the increase in DDRs is likely to be more exponential than linear.

In November, we looked at initial signs of stress in our unsecured loans portfolio. We analysed rising direct debit rejections (DDRs) in Spain and the UK, using real time data to identify areas of potential concern and develop solutions that support borrowers. We saw then that overall mortgage repayments were holding steady, but preliminary rising DDR rates served as a first indication of growing pressure for certain borrower cohorts.

This month, we add to our November report, this time looking at DDR data trends in our Spanish mortgage portfolios from July-Dec 2022 to see not only the impact rising interest rates had on borrowers as credit conditions tightened last year, but also to forecast the impact even higher rates could have in the future.

Spain

Overall delinquency rates across our Spanish performing loans, re-performing loans, and sub performing loans remained steady through the end of last year. The weighted average payrate was 96.6%, in line with the figures we shared in November, while the percentage of loans that are >90 days in arrears declined slightly to 10.3%.

Our data is in line with figures from Banco de España, the Spanish central bank, which said in a report published 27 January, 2023:

NPLs to the resident private sector continued to decline, standing in September 2022 at €43.4 billion, after falling 3.5% in Q3. […]

This development may be influenced by the economic policy support provided to mitigate the effects of the pandemic, which has contributed to improving borrowers’ ability to repay, and by banks’ management of their NPLs (portfolio sales, impaired loan recovery processes, etc.).

We are also seeing Spanish borrowers dip more into savings and turning to other forms of unsecured credit to cover costs – feedback we hear through our call centres. Our mortgage portfolio in Spain is majority (75%) performing and re-performing loans, and our goal is to do everything we can to keep borrowers in the system as performing loans (more on that below). This aim is why it is so critical we track indicators such as DDRs. Identifying early signs of stress means we can contact borrowers immediately to look for solutions that avoid impairment situations.

Such mitigative actions play an important role in keeping default rates as low as possible, but the question is: for how long? Credit conditions continue to tighten whilst financial market uncertainty has risen dramatically in the wake of the bank crises in the US and Switzerland.

In the same report, Banco de España stated:

The results of the Bank Lending Survey show that credit standards appear to have tightened across the board during 2022 Q3, although this tightening was more acute in the case of lending to households, especially for loans for house purchase, which saw the sharpest contraction in supply since 2008.

Households, therefore, are having to rely even more on savings as interest rates, the cost of living, and market uncertainty all continue to rise. Moreover, the recent banking crisis means credit supply looks set to tighten as lenders pull back, even if central banks do not increase interest rates as aggressively as they did in 2022.

Direct Debit Rejections rise with Euribor

Direct debit rejections are one of the first indications of borrower stress that arise in our portfolio, and we can use them to predict levels of strain in the overall market. In Spain, approximately 75% of all mortgages have variable interest rates that update every six or 12 months, which means we see early signs of stress, such as increased DDRs, long before we see rising non performing loans (NPLs). This lag time is important, as it provides us room to act (see below).

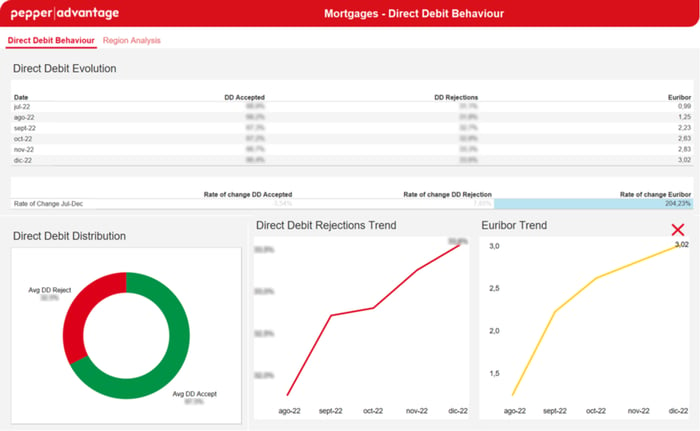

Looking at Spanish mortgage DDRs in the second half of 2022, we saw modest but steady increases every month as the European Central Bank increased interest rates and variable interest rate mortgages were gradually updated to align with Euribor. The overall rate of DDRs during this period increased, on average, +2.35% on a Rate of Change basis.[1] This rise meant that during the last six months of 2022, there was an average 7.85% increase in DDRs, a trend that correlated with increases in Euribor:

The fact that rising interest rates impact borrowers is no surprise; however, by leveraging our rolling data, we can take our analysis one step further and see that there was an average monthly DDR increase of 0.60% for every ECB interest rate rise of 50bps. It is important to note that we do not assume a linear relationship between increases in Euribor and direct debit rejections. In our experience, DDRs are likely to increase at an exponential rate to Euribor over time, especially as mortgages on variable interest rates catch up with Euribor.

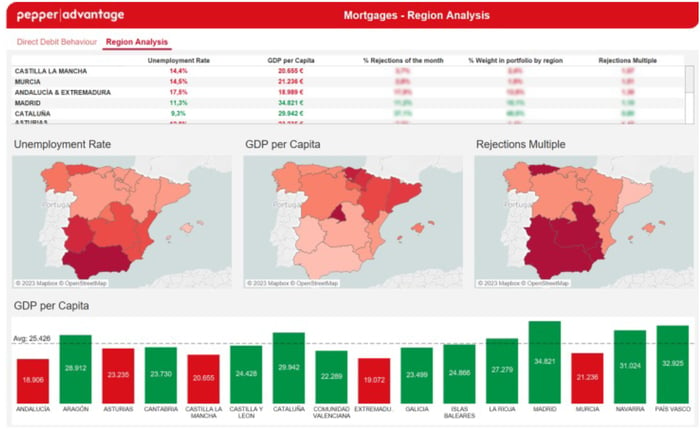

Our regional analysis leverages the latest information from regional GDP and unemployment rates to take this analysis a step further and shows that there is also a strong correlation between the macroeconomic situation and the ratio of DDRs in each region. While it is important to stress that correlation does not equal causation, the ability to track and analyse this data allows us to see where the risk of mortgage defaults could be most acute as inflation continues to outstrip GDP growth:

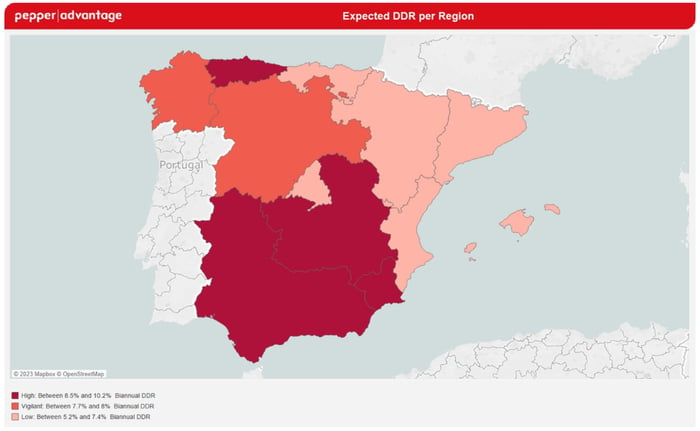

If this correlation is maintained during the next six months, we could reasonably expect direct debit rejection rates to range between 5.18% and 10.2% in different regions, assuming that underlying regional macroeconomic factors such as GDP per head and employment rates remain stable.

In this scenario, regions with lower risk of DDRs would be:

Madrid, Cataluña, País Vasco, Baleares, Comunidad Valenciana, Aragón, La Rioja and Navarra, which would have an expected DDR rate ranging from 5.2% to 7.4%.

Regions with average risk would include:

Galicia and Castilla y León, with an expected DDR rate between 7.7% and 8%.

And the higher risk regions would be:

Andalucía, Extremadura, Asturias, Murcia and Castilla La Mancha, which would have a higher expected rate ranging between 8.5% and 10.2%.

With this data in hand, Pepper Advantage can further tailor its strategies to support borrower cohorts that could be struggling based on their location, current Loan to Value ratio, and/or employment situation. These strategies include:

1. Working with borrowers who have a DDR on a “Promise to Pay”plan, which is where the borrower agrees to pay an instalment within the current month.

2. Offering loss mitigation plans – temporary debt management solutions that are offered to borrowers in the event that they contact Pepper Advantage to request assistance.

3. Soft Discounted Pay Off (DPO) Campaigns – DPOs offer interest, fees and principal debt discounts where appropriate to design feasible resolutions with borrowers with the goal of helping people who may be struggling keep up with mortgage payments and remain in their homes.

4. Soft Restructuring – soft restructures take the form of private payment plans that Pepper Advantage institutes together with borrowers. Pepper Advantage would recommend its clients to take steps such as stopping direct debits and instituting restructured payment plans.

Taken together, these individual steps make up a broader strategy that allows us to support borrowers during challenging times. Our data allows us to see signs of potential trouble, such as increased DDRs, earlier than ever, which means we can take steps to intervene before we see them flow through to rising NPLs. The actionable insights we derive from our credit intelligence platform means that as interest rates wreak havoc on financial markets, we can support clients and borrowers and model the impact future rate changes may have on portfolios, where, and how dramatically. This data becomes even more valuable in the face of our current volatile and uncertain market landscape.

In our next article, we will look at similar data trends in the UK market. Stay tuned for more analysis or subscribe to our newsletter here.

Footnote

1Percentage change in DDRs during an observed time period.

Most read

Pepper Advantage to Acquire Computershare’s UK Mortgage Servicing Business

J.C. Flowers Acquires Pepper Advantage from Pepper Global

Pepper Advantage will manage Servicios Prescriptor y Medios de Pagos loans

Pepper Advantage Announces Closure of Acquisition by J.C. Flowers to Fuel Company’s Next Growth Phase

Prism: Powering the Future with Innovation, Data, and Customer-Centric Technology

Cookie settings