Overcoming industry challenges with technology

01 November 2022

Today’s market landscape poses challenges that requires actionable data to resolve. The need for usable data means that the data alone is insufficient.

It needs to be integrated into technology-driven workflows to help organisations tackle problems as they arise, driving operational and portfolio improvements.

This is how it works.

Technology driven DDR solutions

In our last article, we discussed how our credit intelligence platform revealed early signs of borrower stress in rising Direct Debit Rejections (DDRs) across various geographies and demographics that were not yet reflected by a corresponding rise in delinquencies. In other words, increasing DDRs show some borrowers are beginning to struggle with cashflow, yet the pay rate hasn’t dropped. Why is that?

Pepper Advantage case study: proprietary automated software

One explanation is that we have developed proprietary technology – a Direct Debit Automated Retrials tool – which notifies us of any DDRs when they arise. This tool allows us greater flexibility in collecting direct debits, which helps to reduce delinquencies, and blends as much automation as possible with Pepper Advantage’s servicing team, who decide how to tackle any DDRs in an appropriate manner at an appropriate time. This intelligent use of automation increases efficiency by reducing the number of accounts that are manually collected after an initial rejection, ultimately cutting operational costs.

How does it work?

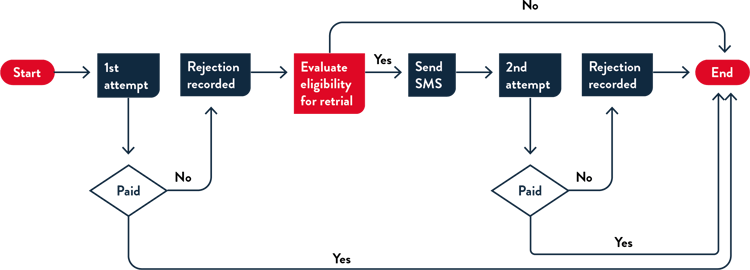

Our Direct Debit Automated Retrials tool sends a second direct debit attempt in a pre-defined timeline if the first attempt was unsuccessful. In other words, if a direct debit payment fails once, our system will automatically attempt to collect a second time at a later date when funds might be available in the borrower’s account.

Pepper Advantage’s Servicing Team works closely with this automation function and decides which combination of portfolios and loan accounts to send the Direct Debit retrial to and when, thereby increasing its success rate.

The diagram below demonstrates the workflow Pepper Advantage service agents run through:

Contact strategies

The Direct Debit Automated Retrials tool also allows us to contact the borrower as soon as a DDR has taken place. After a DDR, our servicing agent works with a borrower to resolve their payment issue or advance notice that a subsequent payment will be taken. You can see the effectiveness of this approach in our data.

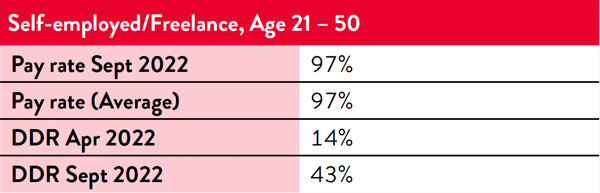

As we saw in our previous blog, DDRs for self-employed/freelance/temporary/unspecified borrowers in Barcelona aged 21-50 have jumped 207% in six months. The payrate, however, remains an impressive 97%, which we believe is a result of our Direct Debit Automated Retrials tool and the experience of our servicing agents. This combination of automated technology and contact strategies is essential because not all borrowers will have funds in their account.

Our call data shows that we have strong contact levels with delinquent borrowers, with the addition of other contact methods, such as SMS, emails and letters. Delinquent borrowers with a call classified as “useful” generally make up less than 20% of total calls overall, but when we focus on calls directed to where we think the early warning signs are – i.e. borrowers in Barcelona aged 21-50 who are self-employed/freelance/temporary/unspecified– that number jumps to 58.9%.

Conclusion

This combination of granular data, proprietary technology and contact strategies allows us to resolve a higher proportion of DDRs more efficiently and helps us get in touch with borrowers to flag potential problems and determine a solution when they begin to show signs of stress. By working with them before problems compound, we are able to maintain pay rates, which is good for our borrowers and our portfolios. Coming up with solutions early will become an increasingly vital task as the macroeconomic conditions continue to fluctuate.

A global credit intelligence platform

The data and insights featured here and in our earlier blog were gleaned from our global credit intelligence platform. It puts market, operational and performance data at our clients’ fingertips, alerting them to potential challenges early and helping them focus on building solutions.

How it works

The Intelligence Platform pulls together data from a range of sources including:

- Customer data

- Transactional

- Loan

- Product

- Collateral

- Legal procedures

- Covenant outcomes

- Voice recordings and conversations

- Business activity data

- Telephone and account activity

- Service level agreements

- Financials

- Pricing

- Servicing credits / recommendations

- Performance data

- Panel vendor activity and outcomes

- User activity

- Third party data

- Macroeconomics

- Customer demographics

- Acquisitions, disposals and underwrite engagements

- Securitisations

The platform then uses machine learning and predictive analytics to generate usable insights. The integration with Tableau’s visualization toolkit provides an accessible way to see and understand trends, patterns, and opportunities, creating actionable solutions.

Automated reports and insights tailored for users

Users of our platform can generate automated reports and insights through a self-service portal, with interactive, visual dashboards that track things such as:

- Outstanding balance of loans across a portfolio or portfolios

- Loan counts

- Average loan balances

- Pay rates

- Interest rates

- Accounts in >90 days in arrears

The platform also allows users to look at trends around:

- Telephone and account activity

- Service level agreements

- Financials

- Pricing

- Servicing credits and recommendations

- Performance data

- Panel vendor activity and outcomes

- User activity

The breadth and depth of data generated by our global credit intelligence platform allows clients to accurately value and predict portfolio outcomes, manage margins in changing conditions and provides a better view of what’s happening to help them make faster and smarter decisions.

Providing an advantage

Pepper Advantage’s global model, driven by expertise and market-leading technological innovation, provides answers to critical business questions that other solutions don’t.

Our direct debit automation innovation is an early example of the data-driven products we are developing to drive operational improvements, while our credit intelligence platform provides real-time insights to drive actionable solutions.

We are here to help our partners and their customers achieve their goals in an uncertain market. Our data-first mindset, proven track record, global perspective and fast deployment allows us to do just that.

Through accessible, actionable and timely insights and transparent, effective technology-driven processes, we can create scalable and consistent credit management solutions to help us meet the challenges of the moment – and the future. We are here to give our customers an advantage when it matters most.

Disclaimer

The material contained in this Article (the “Material”) has been prepared by Pepper Global Servicing Investment 1 Limited (“Pepper”).

No representation or warranty, express or implied, is or will be made with respect to the accuracy, completeness, usefulness or merchantability of the Material or its fitness for a particular purpose or regarding the accuracy of the assumptions or the output or the appropriateness of the parameters used in the calculation of any projections or estimates set out herein or the correlation of the data to the actual or expected performance and characteristics of any transaction and no liability or responsibility is or will be accepted by Pepper or any of its affiliates or associated companies or any of their respective directors, officers, employees or agents in relation thereto. Any use of the Material by the Recipient for any purpose whatsoever will be entirely at the Recipient’s own risk.

This Material may utilise information which has not been independently verified and may include that from public sources and third parties (including market and industry data). Further, this Material may contain forward-looking statements, estimates, forecasts and projections that may be affected by inaccurate assumptions, expectations and estimates and by known or unknown risks and uncertainties are predictive in character and inherently speculative and may or may not be achieved or prove to be correct. The Recipient should not place reliance on such statements.

By accepting the Material, the Recipient acknowledges that (a) Pepper is not in the business of providing advice including legal, tax or accounting advice, (b) there may be financial, legal, tax or accounting risks associated with any transaction, (c) it will seek advice from advisors with appropriate expertise to assess relevant risks and independently determine, without reliance upon Pepper, the economic risks and merits of any transaction and that it is able to assume any such risks and that (d) nothing herein shall form the basis of or be relied on in connection with any contract or commitment whatsoever and neither Pepper nor any of its agents accept liability for any loss howsoever arising, whether direct or consequential, from, related to or in connection with any use of the Material or otherwise arising in connection herewith.

Your receipt and use of the Material constitutes notice and acceptance of the foregoing.

Most read

J.C. Flowers Acquires Pepper Advantage from Pepper Global

Pepper Advantage to Acquire Computershare’s UK Mortgage Servicing Business

Pepper Advantage will manage Servicios Prescriptor y Medios de Pagos loans

Pepper Advantage Announces Closure of Acquisition by J.C. Flowers to Fuel Company’s Next Growth Phase

Prism: Powering the Future with Innovation, Data, and Customer-Centric Technology

Cookie settings